Calculate your net income tax in China

Input the relevant information in the fields below to calculate your 2024 net income, social security, and tax contributions.

**Please note

This Net Income Calculator only provides an approximate calculation of your income based on your input values. As such, this estimation is only for your reference and does not amount to an exact computation. The information provided by the IIT calculator is subject to change based on any adjustments in interpretations, notices issued, or updates provided by the relevant tax authorities.

Receive Tax Assistance

If you have any queries concerning taxes, get in touch with us, and one of our tax consultants can provide you with the assistance you need

Who Qualifies as a Taxpayer in China?

An individual must make income tax payments if classified as a tax resident in China. An individual is considered to be a tax resident in China if they meet one of the following conditions:

- They are domiciled in China; or

- Their residence in China has exceeded 183 days in a calendar year.

If an individual is considered a resident, they must pay taxes on their global income. The scope of taxation includes all wages, salaries, labor remuneration, and other sources of income starting from RMB 5,000.

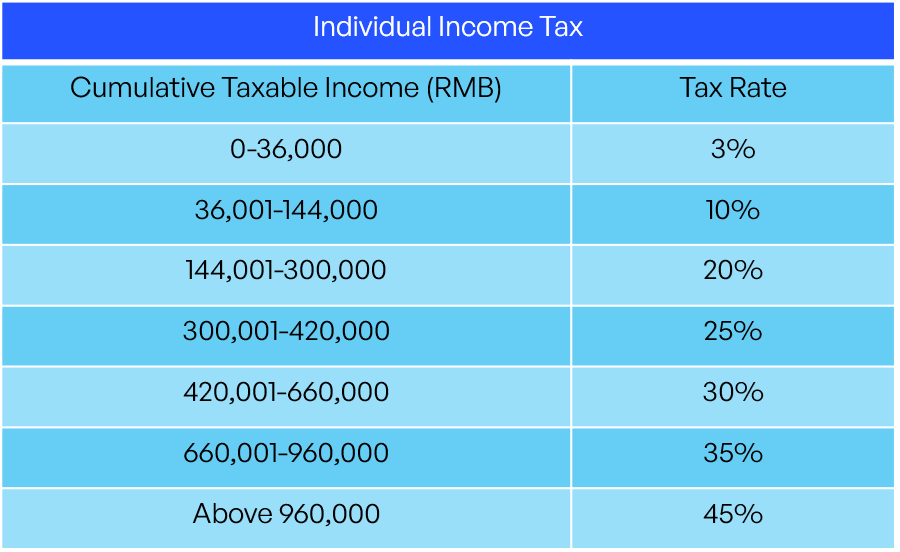

Applicable Net Income Tax Rates in China

China levies different rates depending on the income source. For most individuals employed in China, the most important source of income is Comprehensive income. Comprehensive income is taxed according to a progressive tax rate system, from 3% to 45%. The table below displays the applicable tax rates applied to each income bracket.