In our previous update on the PRC Individual Income Tax (IIT) Law, which had been passed by the National People’s Congress on 31 August 2018, we highlighted a number of important changes. It is clear that the amendments aims to ease the tax burden for low-income earners and take a tougher stance on tax avoidance. Many questions regarding its implementation, however remained open.

On 20 October 2018, the Chinese Ministry of Finance and the Chinese State Administration of Taxation released the Implementation Regulations for the Individual Income Tax Law of the People’s Republic of China as well as the Interim Measures for Itemized Additional Deductions for Individual Income Tax.

Individual Income Tax Reform Transition Period

At the start of the transition period, from October 1st to December 31st of 2018, two changes already came into effect, while the remainder of the amendments will take effect on January 1st, 2019.

The first amendment which already came into effect is the increase of the standard deductions on Comprehensive Income. This deduction went up to RMB 5.000 per month and applies to both local (previously RMB 3.500) and foreign employees (previously RMB 4.800) within China.

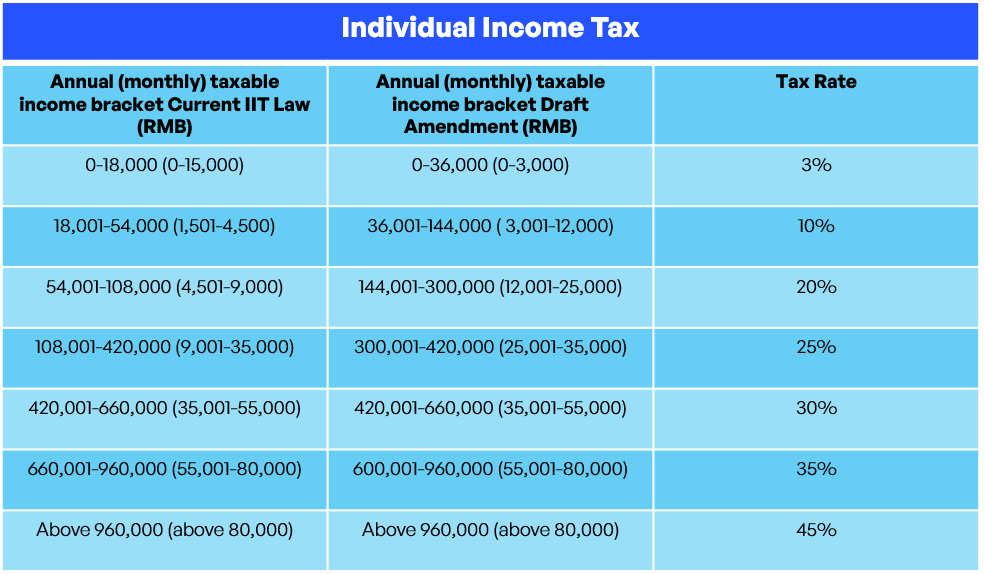

Secondly, the income tax brackets were adjusted from October 1st, 2018. The tax brackets with the rates of 3%, 10%, and 20% were widened, while at the same time the 25% tax bracket has been narrowed; the higher tax brackets were maintained.

Implementation of the IIT Law in 2019

The remaining changes to China’s Individual Income Tax Law will become effective from January 1st, 2019. These are divided into the following:

1. Updating the Tax Residence Rule;

2. Simplifying the Taxable Income Categories;

3. Additional Itemized Deductions;

4. Expatriates will retain tax-exempt benefits;

5. New anti-avoidance rules;

6. Tax Clearance requirements for (Chinese) emigrants.

Updating the Tax Residence Rule

After January 1st, 2019, individuals not domiciled in China will be classified as a resident taxpayer if they stay in China for over 183 days per year. As mentioned in our previous article, this would change the existing rules for residence (1 year) in China and puts this closer to international standards.

Contrary to previous expectations about this new ruling, foreign residents in China will still be able to enjoy the five-year rule. This policy will continue, with some changes. Foreign residents in China can only be exempted from paying tax in China on foreign sourced income if they have left the country for 30 days or more in a single trip in one calendar year, during the five-year period. To claim such an exemption on foreign sourced income, foreign residents in China are required to file such a trip in advance with the local tax bureau.

Simplifying the Taxable Income Categories

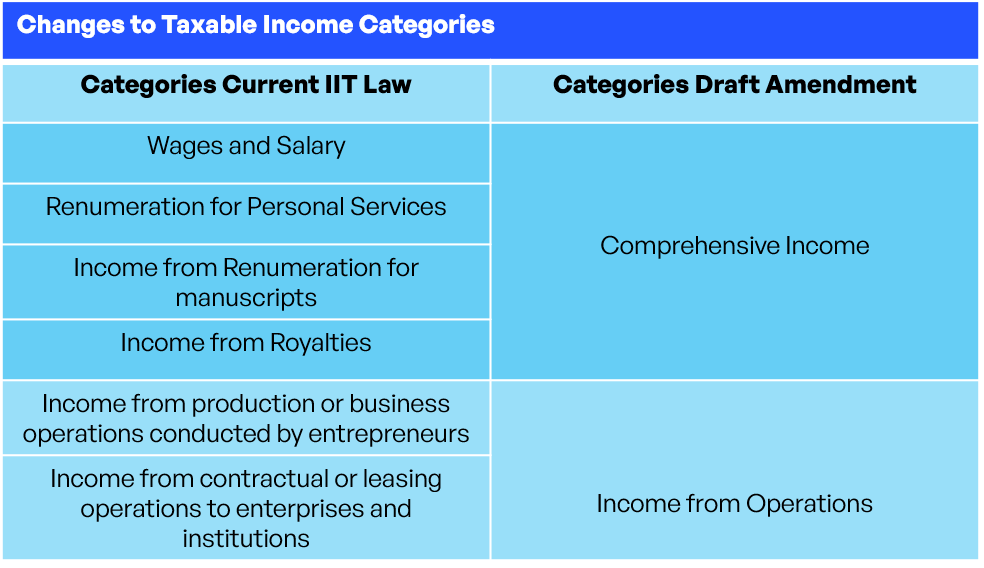

As we highlighted in our previous article, the new IIT law consolidates four categories of labor income into one category of “Comprehensive Income”. For this category one set of progressive tax rates (see above Individual Income Tax table) will apply. In addition, the table below shows that “Income from Operations” previously consisted out of two categories.

Income from operations will also be taxed according to a progressive tax rate from 5% to 35%.

Income from interest, dividend and bonuses, income from the transfer of assets, income from leasing of property, and incidental income will still be taxed separately at a rate of 20%.

Additional Itemized Deductions

The itemized deductions refer to the statutory social security contributions and housing fund. Starting from January 1st, there will be 5 deductible items for additional itemized deductions: (i) children’s education expenses; (ii) continuing education expenses; (iii) medical expenses for critical illness; (iv-a) interest expenses for mortgage and (iv-b) housing rental expense; and (v) expenditures on dependent parents.

Individuals are required to submit information regarding their itemized deduction claims to their tax withholding agent (their employer) or tax bureau. The authorities will hold the taxpayers responsible for the accuracy of the documentation.

Different from the benefits which the expatriates currently can use in China, these deductions would currently not necessarily require “fapiao” proofing that the costs were obtained. We would, however, still need to await how this new policy develops in practice. Furthermore, please note there are certain limitations (which also are based per city level) on the amount of itemized deductions which an individual can obtain.

This policy would, for the first time, allow Chinese employees to plan their personal taxes in China more accurately, and is as a result able to impact all companies active in China.

Expatriates will Retain Tax-exempt Benefits

Expatriates in China may elect to keep the tax-exempt benefits they currently enjoy, such as housing rent, relocation costs, home flight, and laundry expenses.

Foreign employees in China may also choose to claim additional itemized deductions when they meet the eligibility requirements. However, they cannot both enjoy the tax-exempt benefits mentioned above and simultaneously claim deduction for the same expenses under the additional itemized deduction system.

Also, these benefits can only be obtained if the foreign individual has become a tax resident in China, i.e. he or she would have stayed within China for over 183 days for any 12-month period.

New Anti-avoidance Rules

The new IIT law provides a more profound legal basis for tax authorities to investigate and potentially initiate tax adjustments and collect underpaid taxes in cases of tax avoidance. More specifically, the authorities will have a legal basis in case of:

- Related party transactions, where the Arm’s length principle states that related party transactions should be based on fair market value and regular business practice.

- Controlled Foreign Companies (CFC), established in countries/regions with an extremely low-income tax rate; where transactions do not have commercial substance, and those transactions that are arranged with the primary purpose of reducing, mitigating, or deferring tax payment.

- General anti-avoidance rules (GAAR), where individuals obtain improper tax benefits through unreasonable commercial arrangements.

Furthermore, according to this reform Chinese taxpayers can only emigrate to overseas after they have now obtained a tax clearance certificate from the tax authorities; before they are able to cancel their household registration (hukou). They are required to settle any previous underpayments with the tax authority before emigration.

Conclusion

The implementation regulations regarding the amendments to the PRC Individual Income Tax Law has provided answers to several, but not all, outstanding questions:

- It is unclear whether existing preferential policies regarding Annual bonuses and equity incentive plans will be kept.

- It is not clear whether recounting of the five-year period remains possible. Currently, when foreign individuals are a tax resident in China for five consecutive years, and the individual stays in China for less than 90 days in any future year, the five-year period starts again.

- The calculation formula for non-China domiciled individuals would need to be updated.

- We are still awaiting supporting regulations regarding matters such as withholding procedures and annual declaration. Further clarification on procedures for itemized deductions would also be required.

It has become apparent that the new IIT Law will have far reaching consequences for both local and foreign employees in China. It will be important that individuals and employers extensively review the existing IIT amendments and analyze how this would either impact or benefit their personal tax situation.

If you have any questions about this subject, please do not hesitate to contact us.