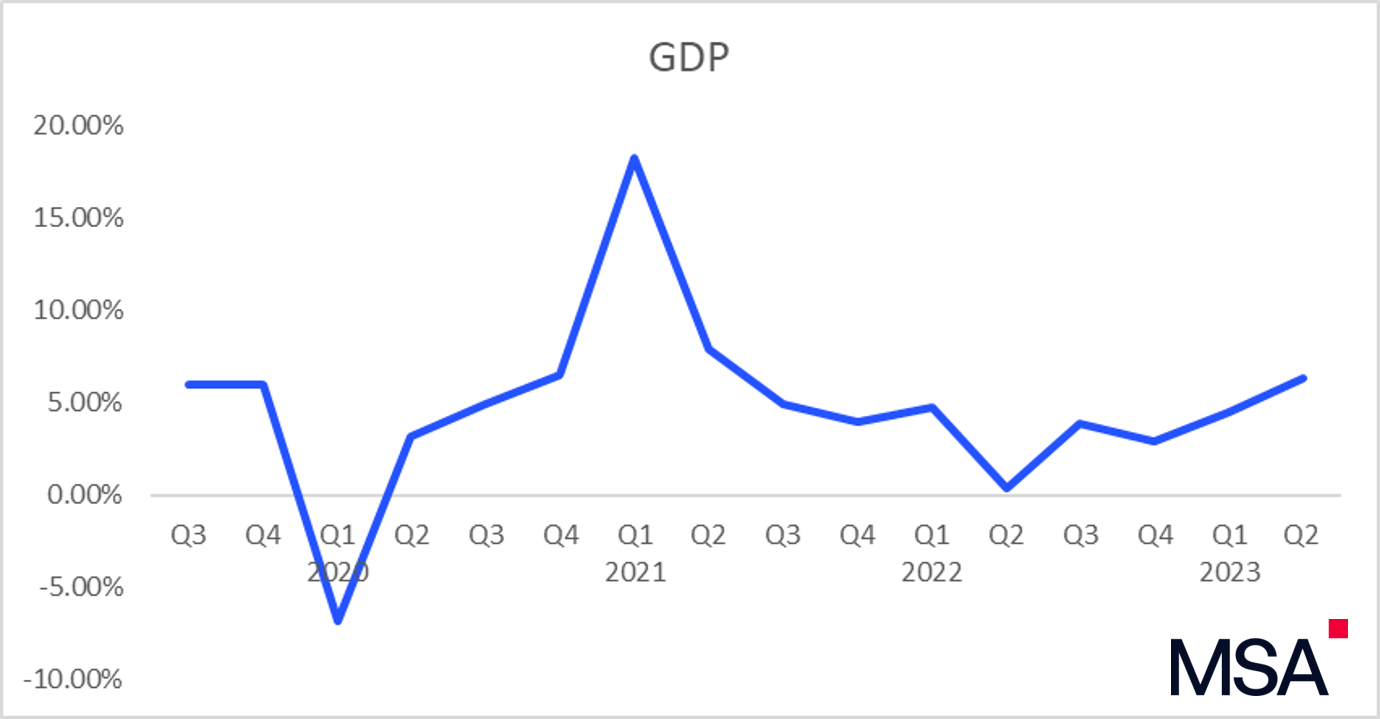

China’s economy experienced a 6.3% expansion in the 2nd quarter compared to the previous year, mainly driven by a low base effect. However, the momentum has slowed down significantly since the strong reopening in the 1st quarter. Data from the National Bureau of Statistics (NBS) reveals that GDP growth was only 0.8% from April to June, falling short of the expectations of economists.

Last year, China faced severe disruptions due to Covid-19 lockdowns, which had an impact on various sectors, as well as the financial hub of Shanghai. The economy displayed a strong rebound in the 1st quarter after the lifting of pandemic restrictions, with GDP growth at 4.5%. Nonetheless, recent economic indicators indicate a slowdown in momentum.

A Slowdown in Growth

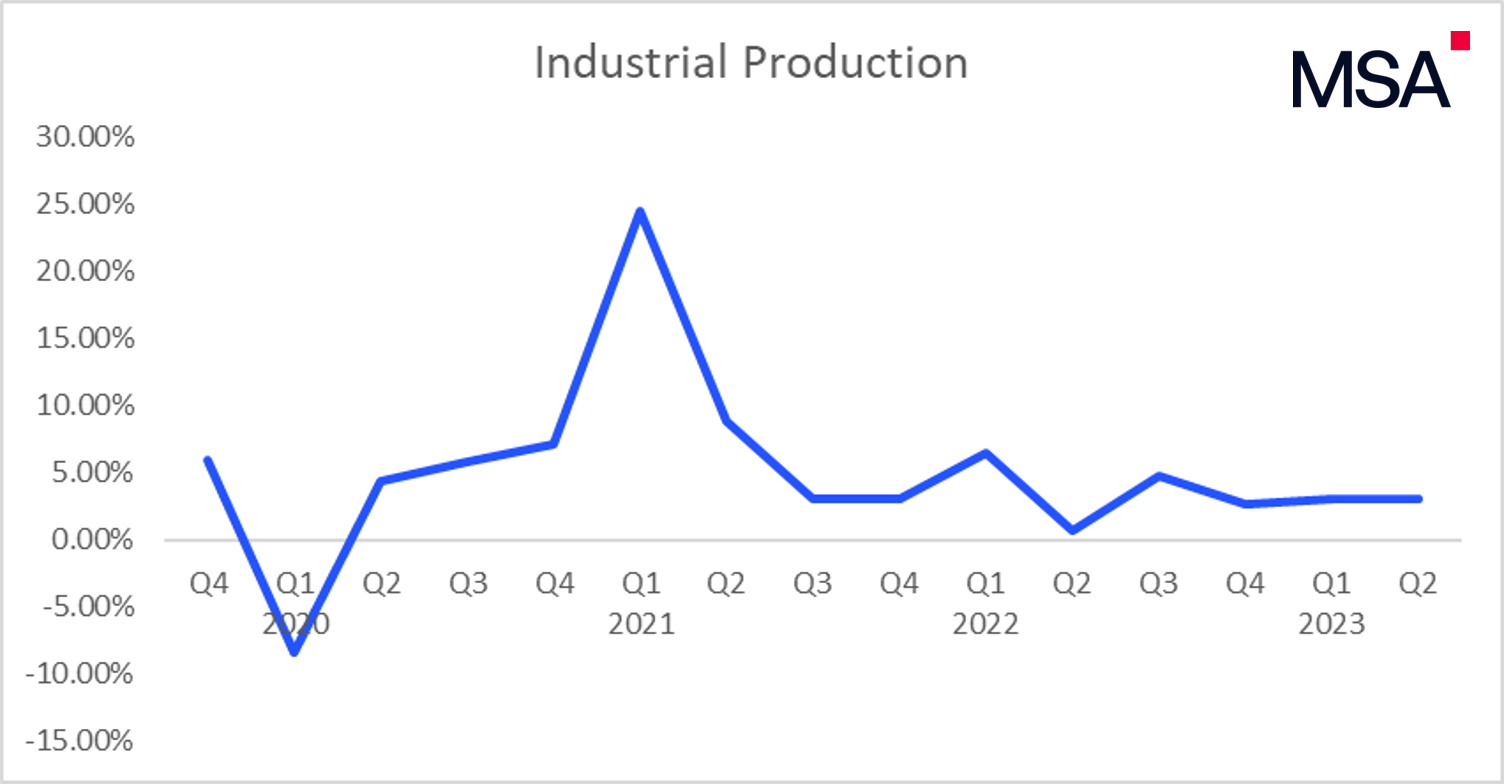

According to the latest data, retail sales recorded a sluggish growth of 3.1% in June, marking the slowest pace since December when most pandemic restrictions were lifted. Industrial output saw a 4.4% expansion in June, while fixed asset investments increased by 3.8% during the same month.

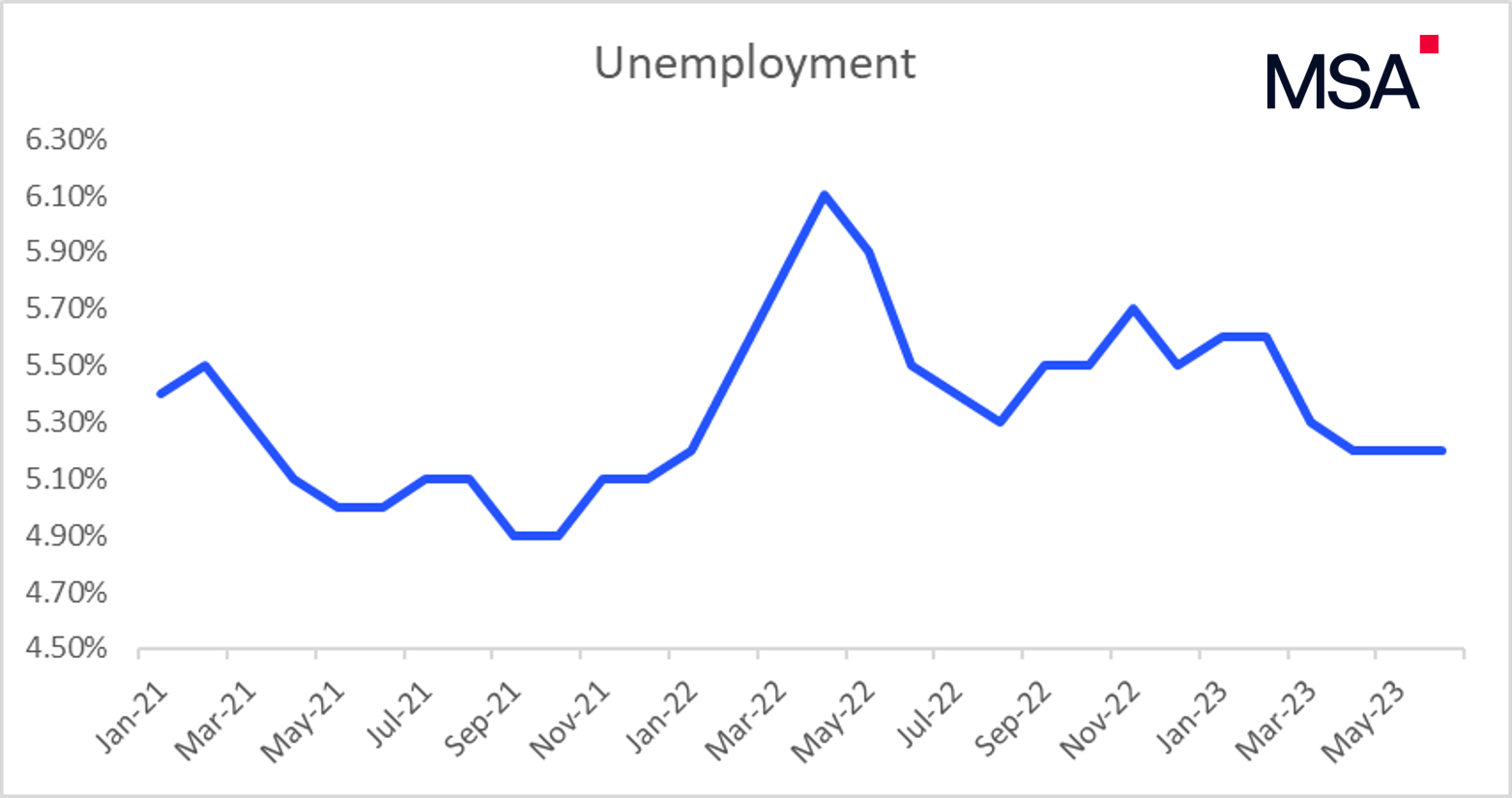

A concerning aspect is the moderately high youth unemployment rate, with those aged 16 to 24 facing a record-high jobless rate of 21.3% in June. This surpasses the previous record of 20.8% set in May, highlighting the challenges faced by young job seekers in the labor market.

These figures indicate a slowdown in China’s economic growth and suggest the need for further analysis and potential policy measures to address the challenges.

Unemployment Rate in Urban Areas Saw a Decline

The surveyed urban unemployment rate in the 1st half of the year averaged 5.3%, with the rate at 5.2% for both May and June, which is the lowest it had been in the past 16 months.

Imports and Exports

During the 1st half of the year, the combined worth of goods imported and exported reflected a year-on-year growth of 2.1%. Notably, the value of exports saw a 3.7% increase, while the value of imports experienced a slight 0.1% decline.

In June the total value of imports and exports was down by 6% year-on-year, which surpassed the expectations of a 4% decline.

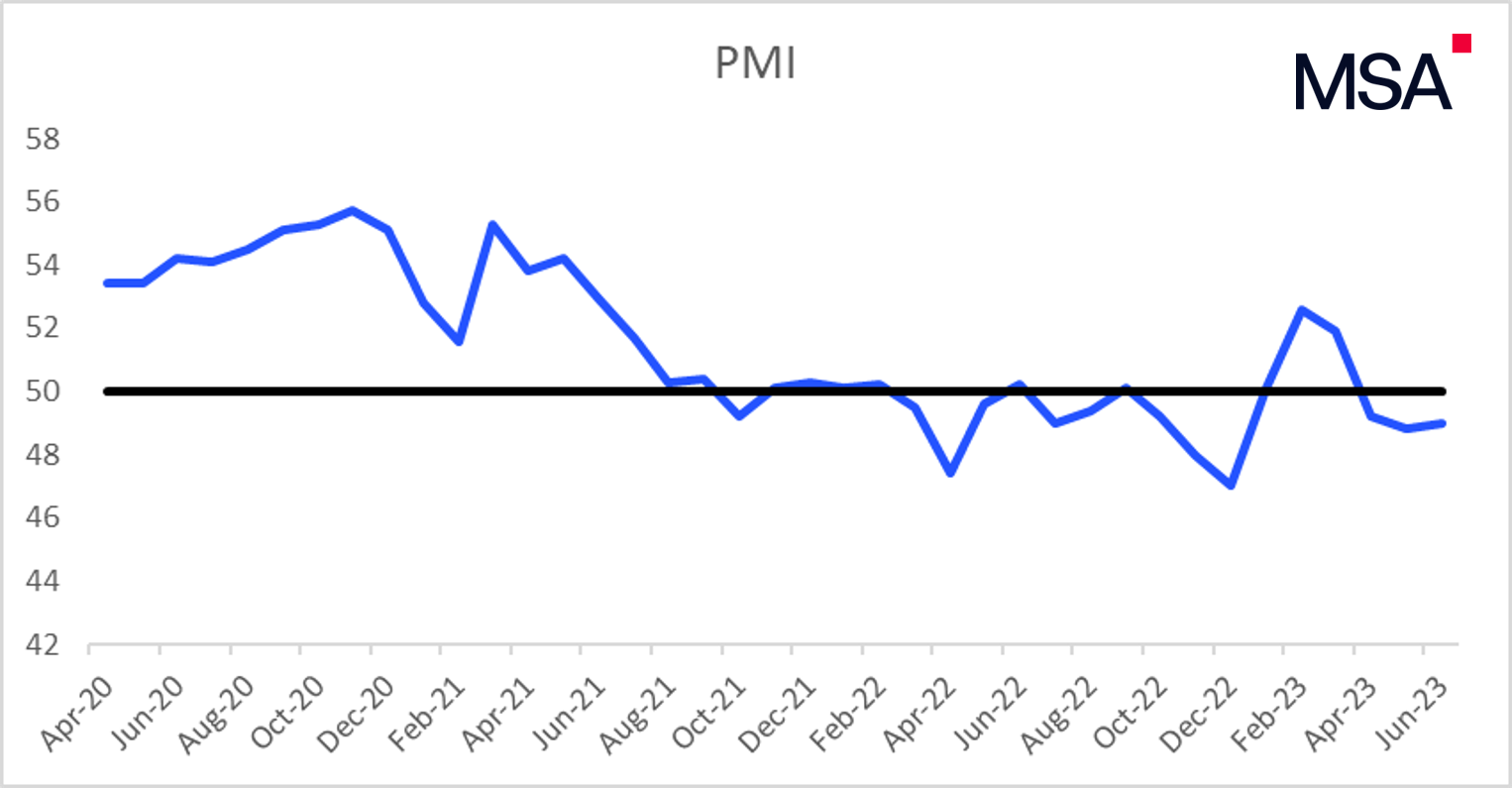

Purchasing Managers Index (PMI) Decreases from Q1

The composite PMI output index for large enterprises is a weighted summation of the manufacturing output index and non-manufacturing business activity index. If the PMI index is 50, this indicates no change, whereas a number over 50 indicates improvement and a number below 50 suggests a decline.

In June, the PMI of the manufacturing industry saw an increase of 0.2% from the position in May, to reach 49%. While still an improvement from the previous month, the PMI reflects that the economy lost momentum in Q2, mainly due to weakened demand.

Value of Industrial Enterprises Experiences a Slight Increase

The value of industrial enterprises above the designated size saw a year-on-year increase of 3.8% in the 1st half 2023. For Q2, this is a 0.8% increase on the 1st quarter.

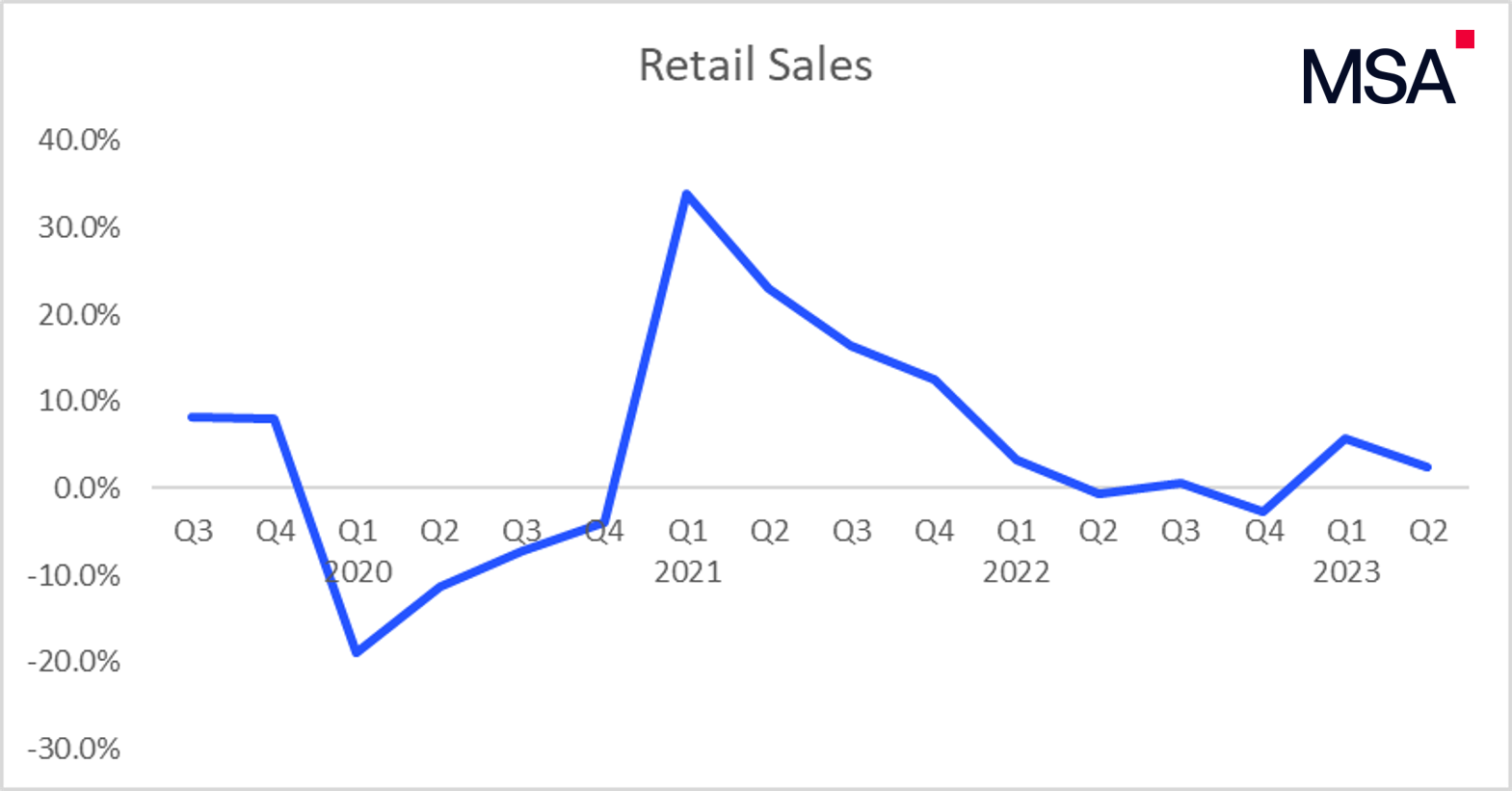

Retail Sales Sees Modest Growth

In the 1st half of the year retail sales of consumer goods increased by 8.2% year-on-year. The total retail sales in June saw a 3.1% increase from the same period in the previous year, which is 0.23% more than the previous month. While retail sales are experiencing modest growth, it still has not seen an increase to pre-pandemic levels.

Outlook on H2

While growth was slow over the 2nd quarter it is expected that policymakers will likely roll out stimulus steps in order to improve performance and keep the economy on the growth target of 5% that was set for 2023.

For more information on navigating the Chinese business landscape, check out “The Complete Guide to Doing Business in China”. You can get it for FREE by clicking on the tab below!

Doing Business in China

If you want to learn more about Doing Business in China, you’ve come to...

Read more