On Monday the 18th of October, the quarterly economic data for the third quarter of 2021 was published by the Chinese government. Despite the GDP growing 4.9% from the same point last year, it did not meet the expected growth of 5.2% predicted by analysts.

The reduced pace of growth has been primarily attributed to energy restrictions that have led to power cuts and supply chain bottle necks which have impacted normal production, as well as an increase in domestic and overseas risks.

GDP Growth Reduced by External Challenges

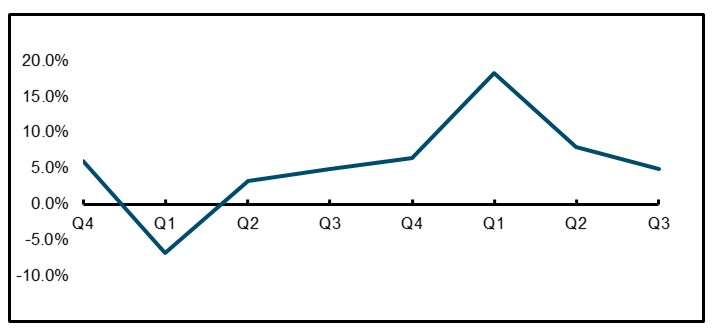

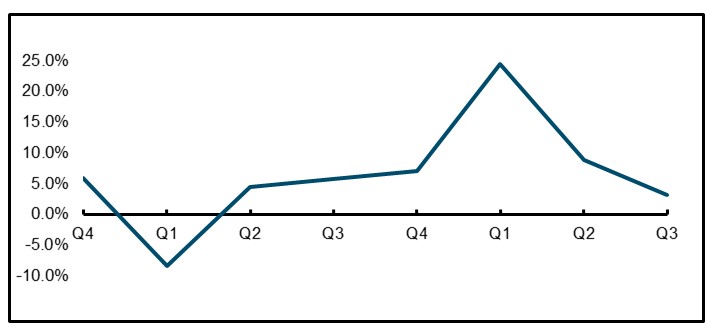

While China did see a 4.9% year-on-year expansion over the third quarter, the growth indicated a rapid deceleration from the 18.3% increase seen in the first quarter of 2021. Nevertheless, the year-to-date GDP growth stood at 9.8% over the first 9 months. Over the past quarter, the economy saw a 0.2% increase, falling short of the expected 0.5% increase, which can be interpreted as a result from the external challenges faced over the quarter.

While domestic recovery has been largely uneven over the course of 2021, the slowdown in growth is an expected after effect of the challenges faced last year. Policymakers are expected to take additional steps to stabilize and ensure ongoing growth, by accelerating the development of infrastructure and easing credit and real estate policies, over the next few months.

Imports and Exports Remain Strong

In the first three quarters, the total value of imports and exports had seen a 22.7% growth year-on-year. The total value of exports was up by 22.7%, while the total value of imports was up by 22.6%

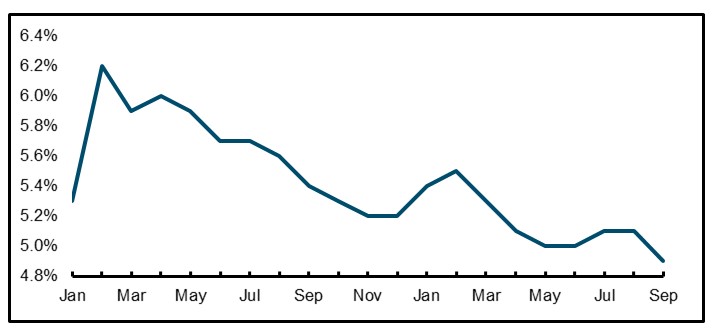

Moderate Decrease in Unemployment

Over the first three quarters a total of 10.45 million people were newly employed in urban areas, leading to 95% of the annual target being achieved. In September, the urban surveyed unemployment rate was at 4.9% which indicates a 0.2% decrease from August and a 0.5% decrease from the previous year.

Purchasing Manager’s Index (PMI) Shows Manufacturing is Down but there are Signs of Recovery

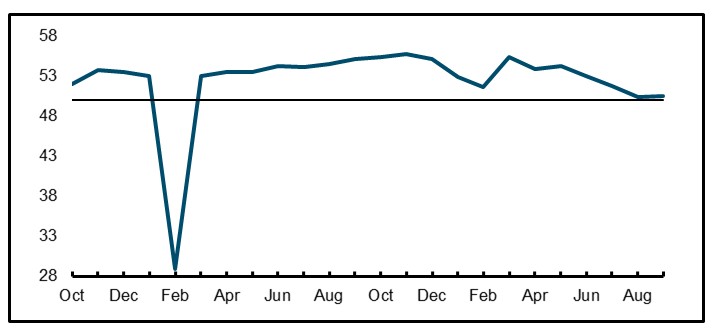

The composite PMI output index for large enterprises is a weighted summation of the manufacturing output index and non-manufacturing business activity index. The PMI is based on five indicators: new orders, inventory levels, production, supplier deliveries, and the employment environment. If the PMI index is 50 this indicates no change, whereas a number over 50 indicates improvement and a number below 50 suggests a decline.

In September, the PMI of large enterprises was fixed at 50.4 which is a 0.1-point increase from August, remaining above the threshold. However, in September the PMI of China’s manufacturing industry dropped to 49.6, which was 0.5 points lower than August. The drop was the first time it fell below the threshold over the past year.

On the other hand, the non-manufacturing industry PMI stood at 53.2, which is 5.7 points higher than the same figure in August, climbing above the threshold, indicating a rapid rebound.

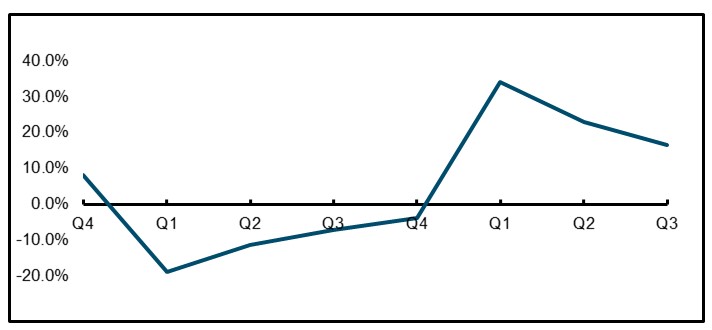

Retail Sales Shows Continued Growth

In the first three quarters of 2021, the total retail sales of consumer goods grew by 16.4% year-on-year, with an average two-year growth of 3.9%. In September, the total retail sales of consumer goods increased by 4.4% year-on-year, which was 1.9% higher than it was in August.

Online retail sales maintained strong continued growth with a year-on-year growth of 18.5%. The online retail sales of physical goods were up by 15.2% year-on-year, which accounted for 23.6% of the total retail sales of consumer goods.

Industrial Production Shows Strong Growth in Specific Sectors

Over the first three quarters, the value added of industrial enterprises, also known as the industrial growth rate, grew by 11.8% year-on-year, with an average 2-year growth of 6.4%. In September, the total value added of industrial enterprises above the designated size saw an increase of 3.1% year on year, with an average two-year growth of 5%.

Per sector, high-tech manufacturing saw an increase of 20.1% year-on-year, with an average two-year growth of 12.8%. In terms of products, the production of industrial robots increased by 57.8%, integrated circuits increased by 43.1%, and new-energy automobiles increased by 172.5%, showing continued strength in year-on-year performance and average two-year growth all exceeding 28.0%.

About MSA

MSA has been providing accounting, financial advisory, and corporate setup services to foreign enterprises throughout China for over a decade. Navigating the complexities of doing business in China and adhering to regulatory policies can be intricate. Our team of experts is dedicated to helping you initiate your venture and maintain ongoing compliance. Reach out to us today, and allow us to support you in successfully achieving your business goals in China.