At the very end of 2022, the Chinese government issued some updates to the current Value Added Tax (VAT) tax law, with a brief review period for public comment. Now that we are well into 2023, the review period is closed, and these changes will be officially enacted within the next few months. What does this look like for businesses who import, export, and trade within China?

Before this legislation, the regulations governing VAT tax in China were a collection of “temporary” regulations issued by the Chinese Cabinet. This meant that the VAT taxes were subject to regular review and re-approval every few years.

It also meant that there was no single codified source of VAT tax legislation that the Chinese government, and businesses providing services, buying goods or selling, could point to as the definitive set of regulations for VAT in China.

This new legislation changes both of these things. Not only does it give the full weight of law from the National People’s Congress to VAT tax in China, but also provides a codified source for all VAT regulations.

It also provides a long-awaited finalization of the VAT tax. The first interim Chinese VAT regulations are thirty years old this year – they were first introduced in 1993. While the regulations have undergone regular updates over the years, most recently in 2016, the Chinese government wants to solidify and codify the various regulations into a law. This new VAT legislation also closes some loopholes and inconsistencies between various iterations of the VAT and business tax regulations.

Let’s look at some of the key updates and changes to Chinese VAT policies under the new legislation.

Lower VAT rates

The new VAT legislation will permanently lower the top VAT tax rate to 13%, down from 16% in the provisional regulations. The Chinese government has stated in the explainer to the legislation that it does not intend to raise this top rate. This will be a relief to businesses across China.

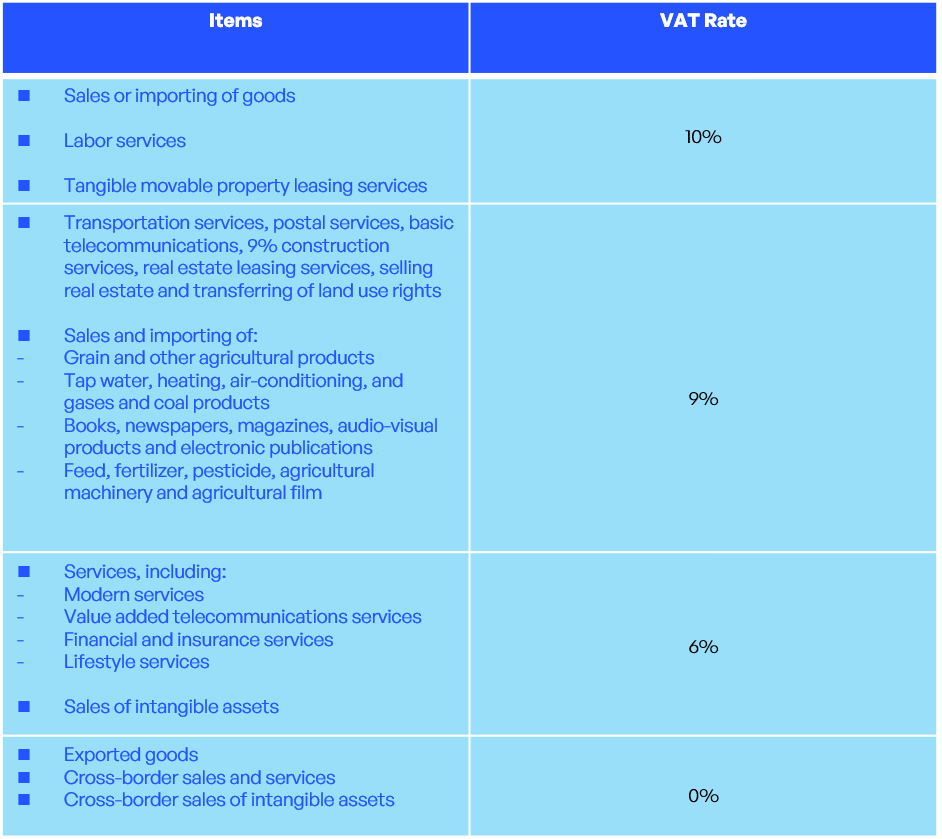

The current VAT rate brackets under the new legislation will be as follows:

Updated Definition of “Domestic Taxable Transactions”

The new VAT law draft includes updated definitions for “taxable transactions” and “domestic taxable transactions.” These updates bring Chinese VAT law in line with the “destination principle”: classifying VAT taxability by the final place where the good or service is consumed.

Previously, either the seller or the buyer had to be within China in order for the transaction to be qualified as a domestic taxable transaction, regardless of where the goods or services themselves were consumed. For instance, a buyer in China who bought an item from a seller outside China would be subject to VAT tax, whether or not the buyer consumed the good in China.

Now, the VAT tax follows the good or service itself, rather than the location of the buyer and seller. If the good was consumed in China, it is a domestic taxable transaction. Even if both buyer and seller are from outside China, transaction and consumption within China means that the transaction is subject to VAT tax.

The new legislation also adds financial products such as stocks, bonds, derivatives, and currencies to the list of domestically taxable goods.

Clarification of Nontaxable and Deductible Items

There is a short list of items that are not subject to any VAT tax. These are different than items taxed at 0% under VAT. The 0% tax items still have to be reported for VAT, but the nontaxable items do not need to be reported for VAT at all.

These items are:

- Wages for services performed as an employee for an employer;

- Government and administrative fees;

- Rewards or compensation for land and resource expropriation or requisition in accordance with the law;

- Income from bank deposit interest.

There is nothing new here; these items were tax exempt under the old regulations as well. They have simply been rewritten for clarity here.

There are also items that, while not exempt from VAT, can be deducted from the total amount of VAT tax the taxpayer has to pay at the end of the year. The new legislation changes a few items in the existing deductible list, while most provisions remain the same.

Some items that normally would be taxable can be deducted from total VAT due if they are purchased for resale instead of for consumption. This avoids double taxation (when the item is purchased to be resold, then again when it is sold to the consumer). It relieves the tax burden on retailers, restaurants, and more.

Domestic passenger transport fares, such as train and bus tickets, are not exempt from VAT but are deductible.

How Does this Affect Your Business?

An explainer document released alongside the new proposed legislation makes it clear that the codification of VAT law is not intended to drastically change how VAT is implemented in China. VAT is one of the major drivers of China’s tax revenue and is at the forefront of business owners’ minds in their day-to-day operations. The Chinese government wants to make it easier for businesses to comply with the VAT law. They also want to incentivize certain business activities that they think will benefit the overall economy the most: tourism, hospitality, exports, service businesses, and agriculture.