*Latest update: August 2023

To support the operations of a subsidiary in China, it is possible to extend an intercompany loan from the parent company to the Chinese entity. However, it must be noted that providing loans to a Chinese subsidiary is characterized by several challenges and companies intending to extend such loans cannot freely bring in funds in the form of a loan. Because the Chinese State Administration of Foreign Exchange (SAFE) strictly controls foreign exchange in China, the amount that can be borrowed by a Chinese subsidiary is limited to the so-called foreign debt quota. Currently, the foreign debt quota is determined by one of two methods, the Financing Gap Method or the Net Asset Method. Because the method chosen impacts the total amount of funds that can be borrowed via an intercompany loan, it is essential to understand how both methods work. In this article we discuss both methods in depth and further highlight key aspects related to intercompany loans such as the interest rates and the foreign loan application procedures.

If you want to find out exactly how to structure an intercompany loan, speak to one of our experts today!

Financing Gap Method

The Financing Gap is the difference between the total investment and registered capital of the Chinese subsidiary. Here the registered capital is the total amount of equity or capital contributions to be paid by the shareholders, and total investment refers to the amount of funds the Chinese subsidiary of a foreign-invested enterprise needs to realize its operations. The amounts of capital and total investment chosen by the company are set out in its Articles of Association (AoA), as drafted during the corporate establishment process (refer to our WFOE White Paper to learn more on the process).

According to the Financing Gap method for foreign debt, the sum of the accumulated amount of medium- and long-term foreign debts and the balance of short-term foreign debts borrowed by subsidiaries of foreign-invested enterprises in China should not exceed the amount of the Financing Gap. Within the gap, a foreign-invested enterprise in China may take on foreign debt on its own. This method is relatively straightforward, as the total investment and registered capital are set out in the AoA, and therefore the debt quota is fixed within these pre-determined margins unless either or both of the two are formally altered via an official application with the Chinese authorities.

How to Calculate the Maximum Amount of Funds that can be Borrowed Under the Financing Gap Method?

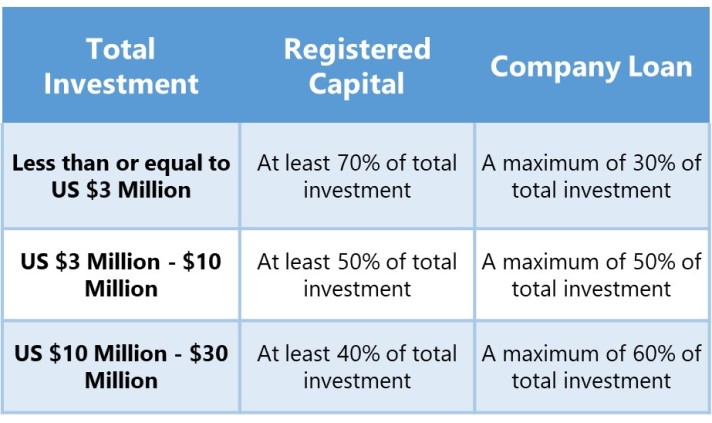

The amount of funds which a Chinese subsidiary can borrow from its parent company using the Financing Gap method, is based on a set of ratios determined by law. The cap on the amount of funds that can be brought into China as a loan is defined by the following ratios:

For example, if the total investment of a Chinese subsidiary is 1 million USD, the total registered capital needs to be at least 70% of the total investment, which would be equal to 700,000 USD. As a result, the amount of foreign debt that can be borrowed by means of a loan is the difference between the total investment and the registered capital, meaning in this example the Chinese subsidiary can borrow 300,000 USD from its shareholder. In addition, the amount of funds that can be borrowed are proportional to the capital that is actually contributed, meaning that if only 50% of the registered capital is contributed, the amount of funds which can be borrowed at that moment is equal to 50% of the financing gap.

The above example shows the importance of carefully considering both the amounts of total investment and registered capital during the company incorporation phase. Although it is possible to alter the amount of total investment and registered capital after incorporation in order to facilitate a shareholder loan, it is important to note that the aforementioned ratios must be maintained.

The Financing Period under the Financing Gap Method

According to the State Administration of Foreign Exchange (SAFE), under the Financing Gap method, a company can choose to apply for long-term foreign debt or short-term foreign debt. Generally, the term of short-term borrowing is up to 12 months; and the period for long-term borrowing shall be 1-3 years.

If the Chinese subsidiary chooses short-term foreign debt, then the subsidiary must repay the foreign debt and the corresponding interest within the stipulated time as set out by the contract. The advantage is that the amount of short-term external debt can be restored after the enterprise has repaid the principal and interest. Meaning that it is possible to use this method on multiple occasions.

If a Chinese subsidiary chooses long-term foreign debt, the advantage is that the shareholder can relieve the cash position of the subsidiary and allows it to repay the external debt within a longer contractual time limit. However, the disadvantage of this method is that the amount of long-term borrowing is not reversible, as opposed to financing through short-term loan. Meaning that this method can only be used one-time and the amount of funds borrowed will be unavailable for future long-term loan applications.

Even though the regulations specify that the length can be below 1 year, or 1-3 years, from our experience, the SAFE can be more flexible. If the SAFE officer in charge can accept it, it may be possible to extend a longer loan. It is therefore important to enter into discussion with the respective SAFE department in your city/district to learn about their requirements for a company loan.

Net Asset Method

The alternative method is the macro prudential management of full-caliber cross-border financing quota method, better known as the Net Asset method. According to a notice from the People’s Bank of China (PBOC) on macro-prudential management of full-caliber cross-border financing (Yin fa [2017] no. 9), the maximum amount of overseas financing for an enterprise is 2 times the value of its audited net assets. The recognition of net assets must be based on the net assets in the latest annual audit report, meaning the latest audit report is used as a parameter to calculate the amount of foreign debt that can be borrowed.

The following formula is used to calculate the total permitted loan amount:

Net assets x cross-border loan leverage rate* x Macro-prudential adjustment parameter

The default value for the macro-prudential adjustment parameter is 1, but sometimes will be adjusted upward or downward by the PBOC based on economic requirements. In October 2022, the PBOC adjusted the rate upwards to 1.25, and in July 2023 the rate was further increased to 1.5. The cross-border loan leverage rate can be up to 2, however, if the SAFE perceives a loan as riskier, for example due to the length of the loan period, it may apply a lower rate, for example 1.5. This would lead to a lower total loan amount that is allowed. Nevertheless, the company can argue for a higher rate or adjust the loan contract terms to ensure the leverage rate of 2 can be applied. The final rate applied is up to approval by the local SAFE.

In line with the Financing Gap method, under the Net Asset method Chinese subsidiaries can also borrow short-term (<=12 months) or long-term (1-3 years) debt. However, according to the Net Assets method, the balance of the amount of funds available for borrowing of foreign debt will be restored after the principal is repaid on time according to the contract, irrespective of the choice for short- or long-term borrowing. In other words, the subsidiary can apply for a foreign loan on multiple occasions.

The larger the size of the enterprise’s net assets, the larger the scale of cross-border financing will be, which will automatically increase with the increase of the net assets, instead of being restricted by the registered capital under the Financing Gap method.

Important to note: foreign-invested enterprises in China may choose either the Financing Gap method or the Net Assets method to apply initially for a foreign loan. Once the company has selected one method, it is not allowed to switch method for future loan applications. Therefore, it is essential to carefully consider the choice of the method when applying for an intercompany loan.

Foreign Loan Interest Rates

When an intercompany loan is initiated and a foreign loan agreement is prepared, it is important for the companies to establish an interest rate based on the Loan Prime Rate (LPR). The LPR is published by the National Interbank Funding Center (NIFC), which is an institution authorized by the People’s Bank of China (PBOC). Generally, the LPR is equal to the most preferential lending rate offered by commercial banks at that period in time and the LPR is calculated by averaging the quotes provided by a panel of several banks.

The LPR is published every 20th day of each month. For example, on July 20, 2023, the 1-year LPR stood at 3.45% and the 5-year LPR stood at 4.20%. This rate is valid until the LPR of the following month is released. It should be noted that the financing period impacts the LPR and in case the term of a loan is extended this will require an alteration as well in the applied LPR.

Even though the regulations set out clear guidelines for the interest rate, which must be set based on the interbank interest rate, similar to the loan term it may be possible to use a lower interest rate, if the local SAFE can approve this. In our experience the local SAFE officers may be more lenient with the applied interest rate, so it’s essential to discuss with the respective SAFE department in your city/district to learn about their policies for a company loan.

Interest payments are deductible for CIT purposes if the amount is reasonable and complies with the arm’s length principles. In China, similar to most service fee and royalty fee arrangements, interest payments are subject to VAT (6%), withholding tax and surtaxes.

Application of Foreign Loan Procedures

For a Chinese subsidiary to apply for a foreign loan, generally the following steps must be performed:

1. Prepare intercompany loan agreement or contract both in English and Chinese (documents must be signed/chopped by all parties);

2. The agreement or contract must be registered with local SAFE within 15 working days of signing;

3. All required supporting documents (e.g., latest annual audit report, application forms, etc.) must be submitted to local SAFE;

4. A special bank account for the purpose of receiving foreign loan (similar to a company’s Capital Bank Account) must be opened. Here it is important to review whether your local bank is permitted to handle foreign debts;

5. The funds in the foreign loan can be deposited on special loan bank account.

Due to the complexity and workload required to complete the above registrations with local SAFE and local bank, many small- and medium-sized foreign-invested enterprises opt to outsource these procedures to a third-party service provider.

The term of the loan as stipulated in the loan agreement should be respected. In case the Chinese subsidiary is unable to repay the loan in time, it must apply for an extension with the SAFE.

Please note these are general procedures that all companies must follow in order to receive a foreign loan. However, it should be noted that companies may need to submit additional documentation to the local SAFE and final approval of foreign loans is up to discretion of the local authorities.

Practical Considerations for Company Loans

Based on our experience supporting our clients with company loans from the headquarters to the subsidiaries, below we highlight a number of practical considerations for intercompany loans:

Loan Bank Accounts

As highlighted above, in order to receive the loan funds, a company must open a specific loan bank account. Normally, when a company sets up different loan agreements, a different loan bank account must be opened for each separate loan agreement. However, some banks may accept using the same bank account for the different loans. Therefore, it is essential to communicate with your local bank branch about their policies.

Multiple Loan Drawdowns

If the company is able to apply for a loan amount that is higher than what the company wants to use on short notice, but the company would like to extend more loans in the future, it is possible to split the loan amount into several portions. This means the company can register a loan agreement for a larger principal amount and only draw down part of that loan, with the intent to use the rest of the balance later. The advantage of this is that the company will only have to draft a loan contract and register the contract with the SAFE once. A drawdown agreement may need to be drafted for internal and bank purposes when drawing down part of the loan each time.

Concluding Remarks

An intercompany loan from the overseas parent to its Chinese subsidiary is one of the options to provide funding for operations in China. As discussed in the introduction, there are some challenges associated with applying for a foreign loan and companies cannot freely bring in funds for a loan.

In China, there are two methods that determine the foreign debt quota for a Chinese subsidiary. Because the chosen method will impact the total amount of funds that can be borrowed and therefore it is important to carefully consider the method to be obtain a loan from the parent company. This decision is even more important because the company must continue to use the chosen method for all future loan applications and because there are a number of other consequences to take into account such as the loan term, interest rates. For advice on which method to choose or support on the application for a company loan, please don’t hesitate to contact us at [email protected]