The State Taxation Administration made an announcement on the 21st of December 2023, regarding the tax filing and payment deadlines for companies in 2024. In order to remain compliant, companies must ensure that the filings are made correctly and on time, especially to avoid any penalties that may arise.

General information on tax filing in China

The taxable period in China runs from the 1st of January to the 31st of December, with tax filing and payments usually made on a monthly or quarterly basis. For individual income tax payments, the payer of the income (usually the employer) is required to withhold the amount of tax payable by the individual. In the case of the payer not withholding the full amount of tax payable, the individual will be liable to settle the amount of tax outstanding.

Annual CIT filing

The annual CIT filing must be completed by May 31st of the next fiscal year. Foreign-invested enterprises that engage in frequent transactions with related parties should additionally prepare an annual affiliated transaction report on transfer pricing issues supplementary to the annual CIT filing. In certain regions of China, foreign-invested enterprises may as well be required to prepare a separate CIT audit report performed by a China Certified Tax Agent.

Annual IIT filing

All companies operating in China are required to submit annual IIT reconciliation filings, in accordance with Chinese legislation. Supplementary tax payments may be required in order to ensure complete compliance with tax obligations.

For more information on Taxes in China, download our Special Report on Taxes Guide.

Deadlines for tax filing

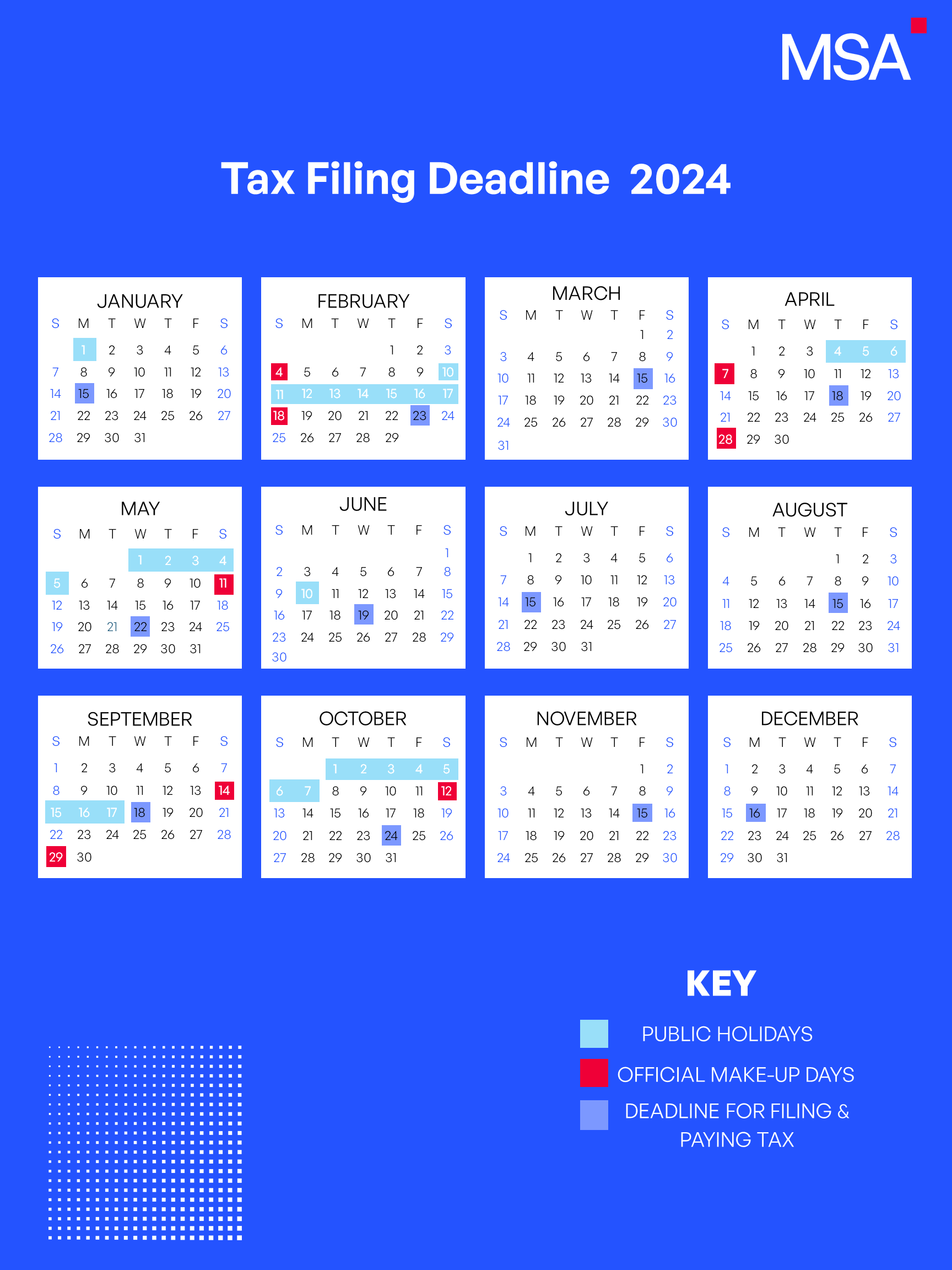

The notice (which is available in Chinese here), outlines the following specific dates:

- The deadline for filing tax returns and making the correct payment of taxes: The 15 of January, March, July, August and November.

- An extension of the tax filing deadline in February: Due to the Spring Festival holiday which is from the 10th – 17th of February, the tax filing deadline is extended to the 23rd of February.

- An extension of the tax filing deadline in April: Due to the holiday on the 4th – 6th of April, the tax filing deadline is extended to the 18th of April.

- An extension of the tax filing deadline in May: Due to the holiday on the 1st – 5th of May, the tax filing deadline is extended to the 22nd of May.

- An extension of the tax filing deadline in June: Due to the holiday on the 8th – 10th of June, the tax filing deadline is extended to the 19th of June.

- An extension of the tax filing deadline in September: Due to the holiday on the 15th – 17th of September, the tax filing deadline is extended to the 18th of September.

- An extension of the tax filing deadline in October: Due to the holiday on the 1st – 7th of October, the tax filing deadline is extended to the 24th of October.

- An extension of the tax filing deadline in December: Due to the 15th of December falling on a Sunday, the tax filing deadline is extended to the 16th of December.

Please see calendar below:

Which taxes are subject to the abovementioned filing and payment deadlines?

For companies that operate in China, the following taxes are applicable and therefore should be adhered to:

Corporate Income Tax (CIT): Corporate income tax is generally levied against a company’s net income after a deduction of reasonable business costs and losses in a financial year. In China, corporate income tax can either be settled quarterly or annually, with adjustments being refunded or carried forward to the following financial year.

Individual Income Tax (IIT): Residents in China are subject to individual income tax on their worldwide income. Non-residents are not required to pay tax on their worldwide income, but instead on income sourced from China. China levies different tax rates dependent on the source of income. Comprehensive tax, which is comprised of the first 4 of the above-mentioned categories, is taxed on a progressive tax rate system from 3% to 45%.

Value Added Tax (VAT): In China there are 2 categories of VAT taxpayers, based on their annual sales; general taxpayers and small-scale taxpayers. The threshold of general VAT taxpayers is now unified at RMB 5 million in annual sales (previously it varied across industries between RMB 500,000 and RMB 5 million). This means all companies with annual sales exceeding RMB 5 million will be a general taxpayer, companies below the threshold will be small-scale taxpayers.

Companies in China will have to file VAT on monthly or quarterly basis. General taxpayers are required to submit their VAT filings on a monthly basis, whereas small-scale taxpayers can submit their VAT filings on a quarterly basis.

The monthly or quarterly tax filing deadline is the 15th day of the subsequent month (i.e., the tax filing deadline for the month of February is March 15th and the deadline for the first quarter is April 15th). If the 15th falls on a weekend, the deadline will be moved to the next Monday.

Surcharges: In addition to VAT, surcharges are also levied in China. The exact rates of surcharges may vary depending on the exact region, but generally include:

- Urban construction and maintenance tax

- Education surcharges

- Local education surcharges

Stamp Duties: All businesses and individuals who receive or execute certain specified documents are subject to paying stamp duty. The rates of this tax may vary between 0.005% and 0.1%, depending on the specific document. Examples of relevant documents on which a stamp tax may be imposed include loan contracts and property insurance contracts. Payment of stamp duties are generally made on a quarterly basis, alongside CIT.

Need more information on tax?

To find out more about taxes in China you can request our Special Tax Guide which provides you with an overview of China’s tax landscape. If you have any specific questions, you can also reach out to us directly with your tax or business query.