Tax System in China

Home to the second largest economy in the world and a population with a continuously increasing spending power, more global investors aim to invest in the Chinese market each year. While certain accounting practices may remain the same, there are particular rules in China that differ from Western countries. Local and foreign businesses operating in China need to ensure that they remain compliant with local laws and regulations, especially regarding taxes. Before the management of an enterprise makes the decision to invest, they should have a comprehensive understanding of the tax system in China and how it works. In this article we give a brief overview of how the china tax system works.

Which Tax Laws Apply in China?

There are several important parts of legislation that give effect to the tax laws in China. Chinese tax laws have had several reforms since their implementation in the early 1980’s and still continue to evolve. As the economy grows and develops, the tax authorities continually aim to promote and create a more stable environment for business to be conducted in.

The most relevant tax laws for foreign individuals and businesses in China include:

- The Corporate Income Tax (CIT) Law

- The Individual Income Tax (IIT) Law

- The Value Added Tax (VAT) Law

Important Taxes in China

The most notable taxes for foreign enterprises doing business in China include:

Corporate Income Tax

Corporate income tax is generally levied against a company’s net income after a deduction of reasonable business costs and losses in a financial year. In China, corporate income tax can either be settled quarterly or annually, with adjustments being refunded or carried forward to the following financial year.

Small and low profit businesses are entitled to a reduced rate of 20%, while a 15% rate is applicable for a certain category of enterprises which are engaged in industries which have been encouraged and promoted by the Chinese government (e.g., high tech enterprises).

The corporate income tax law in China was revised in 2008, unifying the tax rates for domestic and foreign enterprises. The standard corporate income tax rate in China is fixed at a rate of 25%. For non-resident enterprises without an establishment in China, that are taxed on income sourced in China the CIT rate is set at 20%. The amount of CIT payable can also be eligible for certain exemptions or deductions.

For small and low profit businesses a special beneficial tax policy has been implemented. According to regulations set out by the State Administration of Tax, the following CIT rates are applied:

- If a company’s annual profit is below RMB 1 million – a CIT rate of 2.5% is applied.

- If a company’s annual profit is between RMB 1 million and RMB 3 million – a CIT rate of 10% is applied.

- If a company’s annual profit exceeds RMB 3 million – a CIT rate of 25% is applied.

This preferential policy for small and low profit enterprises will remain in effect until 31 December 2021. For more information on this topic check out our comprehensive article on China’s Corporate Income Tax.

Corporate income tax is calculated according to the following formula:

Tax payable = taxable income x tax rate – applicable exemptions/reductions

The State Administration of Taxation requires all companies in China to submit an Annual Corporate Income Tax Reconciliation Report, within 5 months of a company’s financial year end. This is to ensure that a company has met all its tax liabilities and to determine if the company needs to pay supplementary tax or apply for a tax reimbursement.

During 2021, the STA provided an update in the 2021 Government Work Report which stated that the CIT rate for companies with an annual profit below RMB 1 million would be reduced from 5% to 2.5%. This reduction will be valid until December 31st, 2022. No further announcements have been made regarding the other preferential rates.

Individual Income Tax

In China, residents are subject to individual income tax on their worldwide income. Non-residents are not required to pay tax on their worldwide income, but instead on income sourced from China.

There are 9 categories classified as income:

- Employment income – wages and salaries

- Income from labor service payment

- Authors remuneration

- Royalty payouts

- Business/operating income

- Rental income

- Income from interest, dividend, and bonus payouts

- Any income derived from the transfer of property

- Incidental income

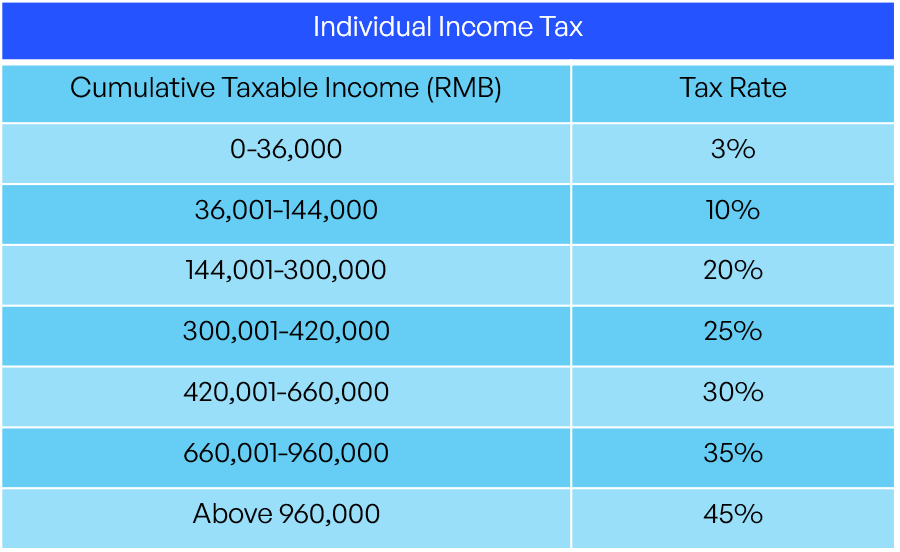

China levies different tax rates dependent on the source of income. Comprehensive tax, which is comprised of the first 4 of the above-mentioned categories, is taxed on a progressive tax rate system from 3% to 45%. For most individuals, their most important source of income generally falls under comprehensive tax. Below we have tabulated the tax rates applicable to the comprehensive income tax bracket:

Withholding Tax

Withholding tax applies to foreign enterprises operating in China, regardless of whether they have an entity in the country. It is a tax that is levied on dividends, rents, interest, and royalties that are derived from China. Essentially it is a tax levied on any income derived from business operations, production, or any other income sourced from China.

Where income tax applies to Wholly Foreign Owned Entities and Chinese-foreign joint ventures operating in China, withholding tax applies to income derived in China by non-resident enterprises. For payment made to non-resident enterprises, the tax is withheld before payment is made. The current rate applicable to such enterprises for withholding tax is set at 10%, which has been reduced from the original rate of 20%.

Business Tax

Business tax is no longer applicable in China due to a major reform of the VAT system. Most of the areas where business tax was relevant and applied are now found under the VAT laws.

Business tax was applicable to businesses that provided services, as well as the transfer of intangible properties and the sale and transfer of real estate in China. Although it applied to the provision of services, it did not apply to processing services and repair and replacement services). Business tax rates ranged from 3% to 20%.

Indirect Tax: Value Added Tax (VAT)

One of the most notable changes to the indirect tax system over the past couple of years, has been the introduction of a single Value Added Tax system for goods and services (read more about VAT in China). VAT is applicable to the sale of goods, except for those activities which fall under business tax. In China, a multiple VAT rate system is applicable which consists of a 3%, 6%, 9% and 13% rate. The standard VAT rate in China is 13%, however the applicable VAT rate for general VAT payers depends on the industry. Generally, for goods the applicable VAT rate would be 13%, while for services it would be 6%.

An important distinction is drawn between companies registered as general VAT payers and companies registered as small-scale VAT payers. The criteria for which category a company may fall under is based on the annual taxable sales amount of a company. Small scale VAT payers are required to pay a VAT rate of 3%, however, to reduce the burden on small scale companies, the VAT rate has been reduced to 1% until the end of 2021.

VAT in China

China’s VAT system is widely considered to be quite a complex system. Over the...

Read moreOther Indirect Taxes in China

There are a number of other indirect taxes, which include:

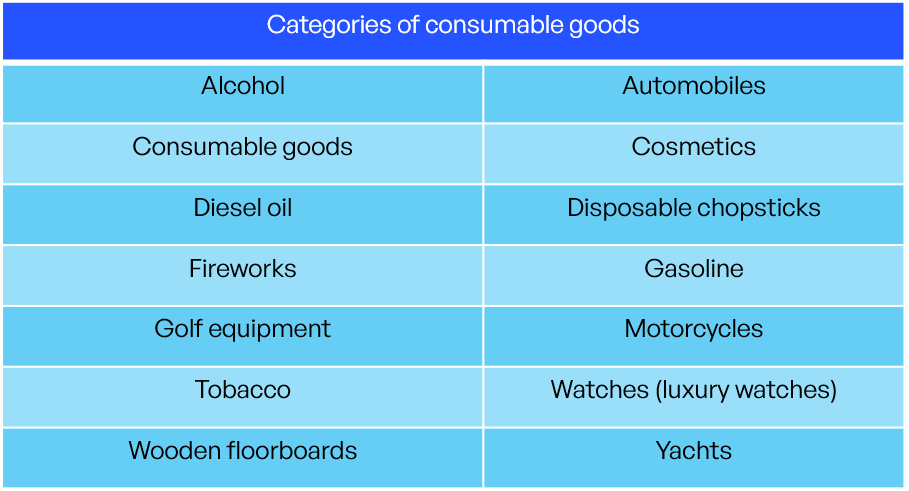

- Consumption tax – this applies to the importation, selling, manufacturing, and processing of certain types of goods, for example luxury goods. The rate of consumption tax varies between 1% – 56% depending on the class and type of good.

Consumption tax applies to 14 categories of consumable goods which include the following:

- Customs duties – this kind of duty applies to goods that are imported and exported, based on the applicable regulations. Import duties are charged based on the total valuation of the goods.

- Stamp duties – all businesses and individuals who receive or execute certain specified documents are subject to pay a stamp duty. The rates of this tax may vary between 0.005% and 0.1%, depending on the specific document. Examples of relevant documents on which a stamp tax may be imposed include loan contracts and property insurance contracts.

Real Estate Taxes in China

Property taxes are applicable to owners or users of a building or house and is applicable at a rate of 1.2% of the original value with deductions applicable or at 12% the rental value. Tax reductions of between 10% – 30% are generally provided by local governments, and real estate tax is also deductible for CIT purposes.

Tax on Resources

Resource taxes are applicable to natural resources. This category is generally taxed at specific rates set out by the Ministry of Finance, on a volume or weight basis. Resources that are taxable include:

- Coal

- Crude oil

- Natural gas

- Nonferrous metallic minerals

- Raw ferrous metals

- Raw non-metallic minerals

Who Regulates Tax Laws in China?

The following bodies are responsible for the introduction, implementation, and amendments of all taxation laws in China:

- The National People’s Congress, as well as its standing committee

- The State Council

- State Administration of Taxation

- The Ministry of Finance

- The State Administration of Foreign Exchange

- General Administration of Customs

Tax laws and regulations are enacted by the National People’s Congress. Any new laws enacted by the National People’s Congress are then further supplemented by administrative rules and regulations, which are formulated by the State Council. These rules and regulations provide detail on effective implementation of the enacted tax laws.

The Ministry of Finance and the State Tax Administration are institutions that are authorized to issue tax announcements, formulate departmental rules and provide official commentary that supplement the tax related regulations promulgated by the National People’s Congress and the State Council. These announcements are made to assist with the interpretation and clarification of tax laws and regulations in China.

Certain tax regulations may be formulated at a provincial or municipal level, by the People’s Congress at a provincial level and its standing committee. Any regulations made by the local level government will only be enforceable in the specific region.

How are Tax Laws Passed on in China?

In China, all laws passed by the National People’s Congress and its Standing Committee must be approved and signed by the Chairman of the country to come into effect. New tax laws are promulgated through the following steps:

1. Proposal

- The State Administration of Taxation and other relevant government departments will request and establish the proposal under specified requirements.

- The annual work schedule is then developed.

- The proposal should then be reported and approved before the schedule is executed.

2. Drafting – generally drafts are drawn by the relevant department which establishes the proposal.

3. Examination – the draft is then examined by the legislature, who determine the following:

- Whether the new regulations are in conflict with existing law.

- Whether the new regulations have higher level laws.

- Whether other relevant departments should co-ordinate on the regulations.

- How to solve any major issues that arise.

- Ensure that the new regulations meet the legislative basis requirements.

4. Publishment – the legislature then reports their opinions and recommendations and final drafts, which the head of the SAT must then sign and approve.

Conclusion

Taxation has a significant effect on most spheres of doing business in China. Understanding the system is important to not only ensure you remain compliant, but also to ensure you are able to navigate the regulatory structures most suitable for your enterprise. It is important to take advantage of your legal rights while remaining within the legal framework.

How MSA Can Help Your Business in China

MSA has been assisting SME’s across China and Hong Kong with all their accounting, financial advisory and business setup needs, for nearly a decade. We are dedicated to delivering high quality through transparency, compliance, and sustainability. Get in touch with us today and let our consultants provide you with the understanding you need to enhance your operation in China.